A Systems Approach to a Rich Life

"A healthy man wants a thousand things. A sick man only wants one." - Confucius

It's 8:30 AM on a gray Tuesday morning in Erie, Pennsylvania, January 2010. I'm three months into my career as an engineer in GE Transportation's Edison Engineering Development Program, still naive enough to think showing up early makes you look dedicated rather than just bad at time management. I'm at my desk, probably overthinking some locomotive subsystem documentation, when one of my colleagues shuffles in looking like he'd been hit by the very locomotives we were designing.

He collapses into his chair with the grace of a failed deployment on a Friday afternoon, looks at me square in the eye and delivers the career advice that would stick with me longer than anything from our technical discussions:

"Hey Mike, do me a favor. Don't get married or have kids."

Then he turned to his monitor and started checking emails like he hadn't just dropped an existential bomb on a 22-year-old who still thought corporate success meant you'd figured out life. I often come back to this moment from time to time.

This became a recurring theme during my time in corporate America and during my time interacting with people in all walks of life. The pattern was so consistent it could've been unit tested: successful engineers, managers, business owners who'd accumulated impressive wealth, drove German cars that cost more than my parents' first house, had 401(k)s that would make r/personalfinance weep with joy - yet they were overweight, exhausted and just not happy.

They'd won the game everyone told them to play. Assets minus liabilities equaled a number that impressed anyone who asked. Yet there they were, living proof that optimizing your life around a single metric isn’t the way to go. Now granted, not everyone had this grim outlook in life; a lot of people were living the dream. Maybe it was being introduced to adulting during the great recession. But man… I interacted with some hardened people in those early years.

Welcome to the paradox of our time: We've gotten so good at maximizing financial net worth that we've forgotten what worth actually means.

The Traditional Net Worth Setup

The standard financial equation we've all been taught - Assets minus Liabilities equals Net Worth - is about as complete a picture of wealth as looking at the Ravens' defensive stats without watching them play. Sure, they're known for good defense, but that doesn't show you the three heart attacks they give you in the fourth quarter or how they somehow make every game against the Steelers feel like defusing a bomb with oven mitts on.

A financial-only focus creates miserable millionaires - people rich in dollars but bankrupt in everything else. They're everywhere in tech, engineering and finance. You know the type: they can calculate compound interest in their sleep but can't compound joy in their waking hours. They've optimized their portfolios while their health portfolios crater faster than WeWork's valuation.

As an engineer, this bugs me. We wouldn't design a system with a single point of failure, so why design a life that way? The answer came to me slowly, through years of watching this pattern repeat across GE, GM, and countless coffee conversations with colleagues who'd "made it" but felt empty. True wealth isn't a number - it's a system. And like any well-designed system, it needs multiple load-bearing components working in harmony.

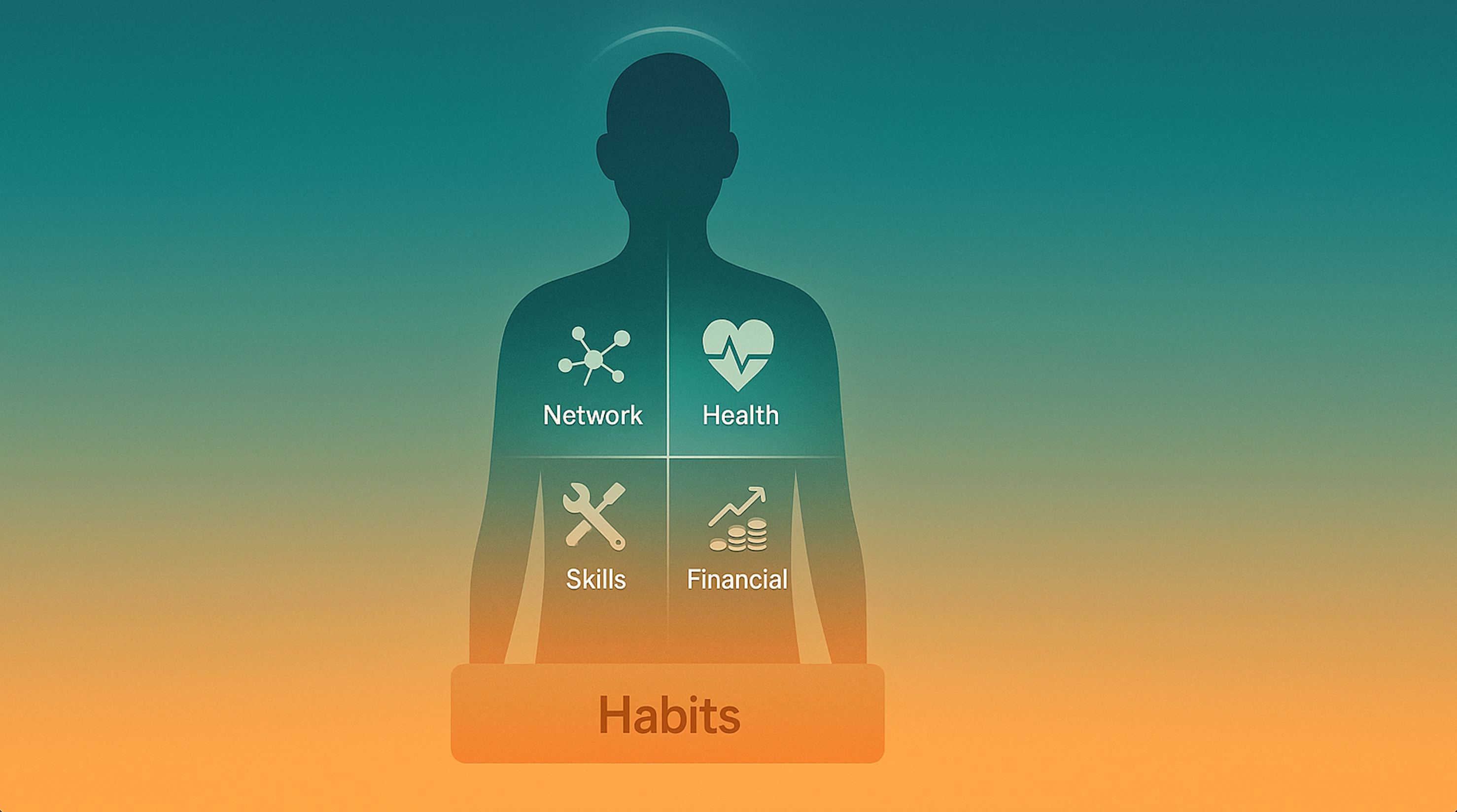

The Four Pillars Framework: An Engineer's Approach

Think of true net worth like a well-architected system. You’ve got four load-bearing pillars – Health, Skills, Network and Financial – all sitting on a foundation of daily habits. Remove any pillar, and the whole structure becomes unstable. Optimize just one, and you’re imbalanced, like routinely skipping leg day.

These pillars aren’t just interdependent; they’re multiplicative. Good health gives you energy to develop skills. Skills make you valuable to your network. Your network creates financial opportunities and around we go.

The priority hierarchy matters too: Health > Skills ³ Network > Financial. It’s not random – it’s the natural order of sustainable wealth building. You can’t buy your way to genuine health, but health can absolutely buy you the energy to build everything else.

Pillar 1: Health – Your Biological Operating System

When you're healthy, you want a thousand things - that new Pixel Watch, the latest EV, maybe a boat (don't buy the boat). When you're sick? You just want one thing: to not be sick.

I think of health in four interconnected components:

- Physical: The hardware. This is your diet, exercise, and sleep. It's the most straightforward to measure and improve.

- Mental: The processor. This is about cognitive performance, a continuous learning mindset, and managing the signal-to-noise ratio of modern life.

- Emotional: The operating system. It’s about emotional intelligence, stress management, and knowing how to respond instead of just reacting.

- Spiritual: The power source. This is your sense of purpose, your "why." It's what gets you out of bed in the morning, reason for being.

Here's where it gets interesting from a financial engineering perspective. Maintaining good health creates an arbitrage opportunity with the American healthcare system. Healthy lifestyle equals high-deductible health insurance equals HSA eligibility equals the only triple tax-advantaged account the IRS hasn't figured out how to curtail yet. Max that out for 30 years, never touch it, and you've got a seven-figure tax-free healthcare fund.

The real ROI on health is energy economics. Better health means deeper work sessions, clearer thinking, and the stamina to pursue opportunities others can't. It's gaining back invaluable time with family instead of spending it in waiting rooms or recovering from preventable illnesses.

My routine isn't complicated: my youngest get me up between 6:30-7am, coffee and paint unicorns with my oldest, working by 8:30, hour workout during lunch, work some more, dinner, play, sleep and repeat. Nothing radical, but it compounds like Buffett's portfolio.

Pillar 2: Skills - Your Value Creation Engine

In my mind, skills come in two flavors: specialized and soft. Specialized skills are what you go to school for - the programming languages, engineering expertise, teaching certifications and domain knowledge that make you professionally valuable. Think of yourself as a T-shaped professional: deep expertise in one area (the vertical stroke) with broad knowledge across disciplines (the horizontal stroke). Though honestly, in 2025, you probably need more of a comb shape - multiple deep specializations with broad connecting knowledge.

But here's what they don't teach in engineering school: soft skills are force multipliers. That brilliant algorithm you wrote? Worthless if you can't explain it to the PM. Your innovative system design? Dead on arrival if you can't navigate the politics to get it approved. Emotional intelligence, written communication, knowing what to say, how to say it and when to say it - this is what separates senior engineers from forever-juniors with senior tenure.

The nice thing about skills as wealth accelerators is they compound faster than any investment. Learn Python and suddenly you can automate tasks. Add cloud architecture, and now you're building scalable systems. Stack on some AI/ML and you're commanding rates that would make your parents question their life choices. Each skill multiplies the value of the others, creating unique combinations that can't be easily replaced or outsourced.

The democratization of learning has made this pillar more accessible than ever. Tools like Coursera and Udemy are easily accessible. AI for learning is a trending feature being integrated across all of the foundation models (I recommend Claude if you want to learn any type of programming language). AWS provides so many pathways to get certified for free, the cost is no longer a barrier. The only barrier to skill development in 2025 is your own discipline and the 23 open browser tabs you swear you'll get back to.

Pillar 3: Network - Your Reputation Compound Machine

Your network isn't just who you know - it's who you are in the minds of others. Think of it as your personal brand. When people see your name, what's their immediate reaction? That visceral response is your true net worth in the attention economy.

Building authentic connections isn't rocket science, though somehow, it's harder for most engineers than actual rocket science. The formula is simple: Do what you say, say what you do. Treat everyone with respect, especially people who can't do anything for you. Listen more than you talk. Ask questions that show you're actually paying attention, not just waiting for your turn to speak.

I learned this the hard way at GM, watching brilliant engineers with amazing ideas get passed over because they couldn't build coalitions. Meanwhile, moderately talented folks who understood relationship dynamics were driving major initiatives. The harsh truth? Being right isn't enough if no one wants to work with you.

But here's the part nobody talks about: your most important network starts at home. Healthy family relationships provide the emotional stability to take professional risks. Every successful person I know who's also genuinely happy has this figured out. The ones who don't? They're my colleague telling a 22-year-old to do thema favor and not get married and have kids.

Pillar 4: Financial - The Output Variable, Not the Input

Money, at its core, is simply a claim on other people's labor. Every dollar in your account represents your ability to command someone else's time and expertise. That $6 coffee? You're claiming three minutes of a barista's labor. First-class flight? You're claiming a larger share of the pilot's attention and the flight attendant's service. Private jet? Now you're claiming exclusive access to an entire crew's labor.

When you see money as a claim on labor, you start making different choices. Do you really want to trade your specialized engineering labor for someone else's landscaping labor? Maybe. Maybe not. Some people love cooking as meditation; others see it as time stolen from hobbies. Neither is wrong, but being intentional about these trade-offs puts things into perspective.

The traditional components still matter. Assets like real estate and stocks are just mechanisms for claiming future labor. Your rental property is a claim on construction workers' past labor and property managers' future labor. Your index funds are claims on the collective labor of thousands of companies' employees. Tax-advantaged accounts optimize these claims so the government takes a smaller cut.

But here's what makes the financial pillar different from the others: it's an output, not an input. You don't get wealthy by focusing on wealth. You get wealthy by being healthy enough to work consistently, skilled enough to create value and connected enough to capture that value. The money follows naturally, like weight loss follows a consistent diet and exercise plan.

My approach to financial optimization isn't about maximizing dollars - it's about maximizing the entire system. Sometimes that means spending money to buy back time for health. Sometimes it means accepting lower pay for better learning opportunities. Sometimes it means walking away from lucrative opportunities that would destroy your relationships at home.

Traditional wealth building says trade your time and health for money. Integrated wealth building says create systems that generate value sustainably. One approach leaves you rich and miserable at 65. The other leaves you free to choose at 45.

The Habits Foundation - Your Daily Operating System

All these pillars rest on a foundation of habits—the small, daily actions that compound into extraordinary results or spectacular failures. Think of habits as the muscle memory of your behavior: actions practiced so often they become automated and second nature, powerful enough to make or break your entire system.

My daily routine touches each pillar without feeling like I'm running through a self-improvement checklist. Morning painting habits set the tone as to “why” I woke up in the first place. Lunch break workout habits keep the body and mind sharp (currently on an upper, lower and Abs/Cardio split). Afternoon learning and connections maintain the skills and network. Evening financial reviews keep the money machine humming. It's not perfect, but it's consistent, and in the long run, consistency beats intensity every time.

The systems approach to habit formation is pure engineering: build feedback loops, measure leading indicators, iterate based on results. My Pixel Watch 3 doesn't just track steps; it's measuring the health pillar. My GitHub commits aren't just code; they're skill development artifacts. My email response time isn't just courtesy; it's network maintenance.

The compounding effect happens when habits cross pillars. That lunch stair master session while listening to technical podcasts? Health plus skills. That meeting where you help a colleague figure out how to prompt a Custom GPT? Skills plus network. That HSA contribution from your healthy lifestyle choices? Health plus financial. Everything connects, like a well formulated game-plan where the Ravens run through the steel curtain like a runaway locomotive in notch 8.

The Path Forward

So here's the thing about redefining net worth this way - it's actually harder than just grinding for dollars. It requires thinking holistically, acting strategically and sometimes making choices that look stupid on a spreadsheet but make perfect sense in the broader system.

Start by auditing your current state across all four pillars. Where are you strong? Where are you one bad day away from catastrophic failure? Most people find they're over indexed on one or two pillars while completely neglecting others. That's your opportunity.

If you're like most people, you may be solid on skills, mediocre on financial and struggling with health and network. Start with health - it has the highest ROI and enables everything else. You can't upskill your way out of a heart attack and no amount of network connections will help if you're too burned out to maintain them.

The irony? When you stop obsessing over financial net worth and start building true wealth across all pillars, the money problems tend to solve themselves. It's fixing the root cause instead of patching symptoms - a concept every engineer understands but somehow forgets when it comes to life design.

Remember Confucius and his thousand desires? That's not about material wants - it's about having the health, skills, connections and resources to pursue whatever captures your curiosity. That's true wealth: options, not just dollars.

Time to rethink the game. Traditional net worth is a single metric in a multi-dimensional optimization problem. Time to upgrade your algorithm.

Your future self - the one with energy, purpose, connections, and yes, financial security - is waiting.

What's your take on the four pillars? Drop me a line at mdsweatt@gmail.com or find me overthinking systems design on mikescorner.io.